FDIC Warns Banks of an Increase in "Money Mule" Scams

As if we didn't have enough to worry about in our suffering economy we get news from the Federal Deposit Insurance Corporation (FDIC) now warning financial institutions about an increase in the number of banking criminal activity from "money mules" used to transfer funds from hacked online banking accounts.

As if we didn't have enough to worry about in our suffering economy we get news from the Federal Deposit Insurance Corporation (FDIC) now warning financial institutions about an increase in the number of banking criminal activity from "money mules" used to transfer funds from hacked online banking accounts.

"Money mules" has become a term for people who were hired through those infamous work-at-home scams who find themselves assisting in cybercriminal money laundering activities that usually takes place overseas. Little do some of the work-at-home "employees" know that they are duped into assisting in criminal activity or basically, money laundering.

The FDIC has identified that these incidents involve cases where banking customers make several deposits, totaling less than $10,000 so a red flag is not raised, and then withdraw all of the money with the exception of 10%. The 10% is the mule's commission for their work. How generous of the cybercrooks to actually pay the workers for doing a bad deed.

An increasing amount of cybercriminals are using money mules to target banks and financial databases. The cybercriminals will usually first break into an online banking service such as a payroll processing database where they can obtain names, email addresses, usernames and passwords and then use this information to instruct their money mules to transfer funds. You can only imagine how valuable this information is until someone gets caught.

Other victims of the complex scams to steal money from online banking accounts are those who fall victim of cyber theft in either a phishing scam or stolen login credentials. Even so, some of the accounts that are compromised belong to businesses and not just individuals.

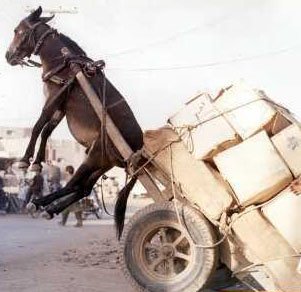

Cybercriminals are also known to utilize banking Trojans or viruses that infiltrate the computers of victims. These Trojans are password stealing parasites designed to seek out online banking login information. This makes the "money mule" scheme a relentless extortion tool. Gone are the days of walking into a bank with an AK47 ready to make away the vaults stash of green paper. Crooks have taken bank theft to the hi-tech streets.